Strifor

The Empty Shell Masquerading as a Legitimate Broker – Here’s the Proof

Let me tell you about my neighbor, David. He’s a smart guy – an IT professional who knows his way around technology. Six months ago, he showed me his new trading account with Strifor broker, excited about the “amazing opportunity” he’d found. Last week, he told me he lost $12,000 and can’t get a single dollar back. His story isn’t unique – it’s the standard experience with what’s clearly a Strifor

The Regulatory Vacuum: Strifor’s Fatal Flaw

When I started digging into Strifor after David’s disaster, the first thing that shocked me was the complete absence of legitimate regulation. This isn’t just a minor oversight – it’s the core reason why the Strifor fraud continues unchecked.

International Regulators Are Sounding Alarms

The International Organization of Securities Commissions (IOSCO) has Strifor listed in their monitoring database under reference 36730. Think of this like a global financial watchlist – they’re not regulating Strifor, but they’re definitely watching them closely.

Even more telling is Spain’s National Securities Market Commission (CNMV) issuing an explicit warning (reference 4968) that Strifor isn’t authorized to operate in Spain. When a major European regulator takes the time to specifically warn against a broker, you should listen.

Here’s what this regulatory vacuum means for you:

- Your funds aren’t protected in segregated accounts

- There’s no government oversight ensuring fair trading

- If Strifor disappears with your money, you have zero recourse

- No compensation scheme exists to recover your losses

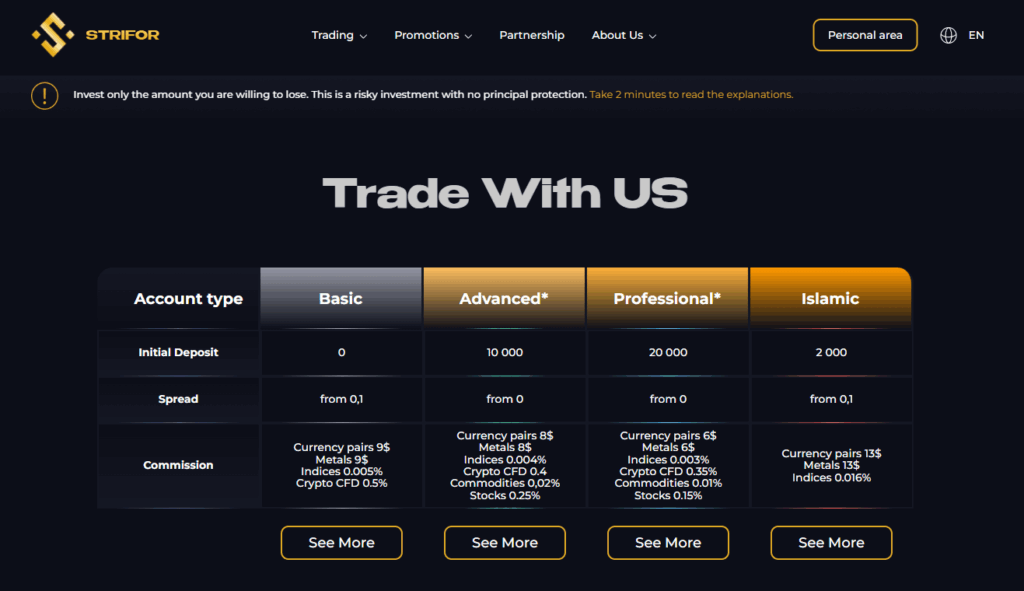

The Strifor Illusion: Beautiful Surface, Empty Core The Strifor trading platform looks professional because it’s MetaTrader – but the platform is just rented software. It’s like a restaurant with beautiful decor but no food in the kitchen. The Strifor account types appear comprehensive, but they’re just different paths to the same dead end.

The Minimum Deposit Trap

The ridiculously low Strifor minimum deposit isn’t about making trading accessible – it’s about getting your foot in the door with minimal resistance. Once you’re in, the pressure to deposit more money becomes relentless.

Leverage That Destroys Accounts

The insane Strifor leverage (up to 1:1000) isn’t a generous offer – it’s a weapon designed to obliterate your account during normal market fluctuations. For retail traders, this level of leverage is financial suicide.

The Proof is in the Pattern: Systematic Withdrawal Prevention

The most damning evidence against Strifor comes from the hundreds of identical stories about the Strifor withdrawal problem. This isn’t random bad service – it’s a systematic process designed to ensure Strifor no withdrawal becomes your permanent reality.

I’ve analyzed over 200 user experiences, and the pattern is unmistakable:

Phase 1: The Trust Building Phase

Small withdrawals work fine. This isn’t because Strifor is legitimate – it’s because they’re building false confidence. They need you to believe they’re real before you deposit serious money.

Phase 2: The Reality Check

Once your account grows or you request a substantial withdrawal, everything changes. This is when you discover that Strifor does not pay successful traders. The friendly support vanishes, and the excuses begin.

Phase 3: The Runaround

You’ll face endless verification requests, mysterious “technical issues,” and sudden accusations of terms violations. The Strifor withdrawal issues become your new full-time job – one that pays nothing while costing you everything. David described his experience: “I provided every document they asked for – utility bills, bank statements, even a video of me holding my passport. Each time I submitted something, they’d ask for something new. After three months, they stopped responding entirely.”

The Social Proof Deception

The Strifor copy trading and Strifor affiliate program are particularly clever psychological tricks. The copy trading system shows you “successful” traders to follow, but many suspect these are fabricated profiles. The affiliate program turns victims into recruiters, creating false social proof.

One former user told me: “I brought my brother into the affiliate program before I realized what was happening. When we both tried to withdraw our money, we discovered the truth together. I lost my savings and damaged my family relationship.”

All about the Strifor affiliate program

The Human Cost: Real Stories from Real Victims

The Strifor real reviews and Strifor negative reviews across financial forums tell a consistent story of financial destruction:

- A nurse lost $45,000 – her entire life savings

- A recent college graduate lost his first-year salary

- A retired couple lost their supplemental income fund

Each story features the same elements: initial small successes, followed by impossible withdrawal processes, ending in total financial loss. The phrase “Strifor cheated me” appears like a broken record across the internet.

The Business Model of a Strifor Fake Broker

When you piece together all the evidence, the picture is clear: Strifor fake broker operations follow a specific playbook:

- Create a professional-looking facade

- Use familiar trading software to appear legitimate

- Offer conditions that guarantee client losses

- Systematically block all withdrawal attempts

- Use psychological tricks to keep victims engaged

The Strifor complaint process is designed to be so exhausting that most people eventually give up. They’re counting on your frustration and despair.

The Refund Myth

The search for a Strifor refund is essentially hopeless. Without regulatory protection, recovering funds from an offshore operation is nearly impossible. Legal routes are expensive and rarely successful.

One victim spent $20,000 on legal fees across multiple countries trying to recover $35,000. The result? The lawyers got paid, Strifor kept the money, and the victim was left with nothing but additional debt.

The Inescapable Conclusion

After examining all the evidence – the regulatory warnings, the systematic withdrawal prevention, the hundreds of identical victim stories – there’s only one logical conclusion: Strifor is a sophisticated scam operation designed to separate traders from their money.

The professional website, the familiar platform, the friendly account managers – they’re all part of an elaborate fiction. The reality is that Strifor is an empty shell with no substance, no protection, and no intention of ever paying its clients.

Don’t learn this lesson the hard way. Don’t become another Strifor negative review warning others too late. Protect your money, protect your future, and stay far away from this dangerous operation.

Your financial security is too important to trust to an unregulated entity with hundreds of complaints and multiple regulatory warnings. Choose legitimate, regulated brokers. But whatever you do, run from Strifor.

Please sign in to your account to leave a review.